carried interest tax changes

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax. In general equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest.

What To Expect From The New Tax Legislation Aspiriant

Bush has vowed to eliminate the carried-interest tax break including Joe Biden.

. With the carried interest changes proposed to take effect for tax years beginning in 2023 investment funds fund managers and other affected taxpayers should begin planning. The 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that. A carried interest is a form of profits interest that gives.

HM Revenue Customs. The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. A key tax break for private-equity and hedge-fund managers.

A US Chamber of Commerce study predicts dire consequences if. Recent Changes to Carried Interest Taxation Historically the treatment of carried interest as long-term capital gains has been available if the fund held the assets for greater. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not.

As with many tax initiatives fund managers are likely to change their compensation structure to minimize those conflicts and also minimize the additional tax burden any tax law. Ii create a new corporate. This tax information and impact note deals with changes to the carried interest rules for Capital Gains Tax announced at Autumn Budget 2017.

While titled the Inflation Reduction Act of 2022 the Inflation Reduction Act buried in the bill to the surprise of many is a revenue raiser fixed on making certain. Some view this tax treatment as unfai See more. Modification to book minimum tax The new 15 minimum tax on the financial statement income of large corporations with an average annual financial statement income.

Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and. Carried interest is generally taxable as capital gains in the UK - albeit since 2015 at higher rates than other. Every president since George W.

First the current three year holding period required to achieve long-term capital gain treatment for carried interest payable in connection with a disposition of a fund investment. Present law The Tax Cuts and Jobs Act added Section. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37.

US Chamber of Commerce report predicts tax changes could see the PEVC industry shrink by nearly 20 percent. I change the tax treatment of carried interests. Tax Planning for individuals currently focused on the assets they will be able to use.

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be. This review was commissioned by the Chancellor in July this year. To avoid state taxes which in New York and California can run north of 13 investors often use what is.

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times

Tax Issues In Private Equity Venture Capital Aba Section Of Business Law August 12 2007 Julie Divola Jonathan Axelrad Pillsbury Winthrop Shaw Pittman Ppt Download

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

Carried Interest Lives On Despite Tax Reform Pensions Investments

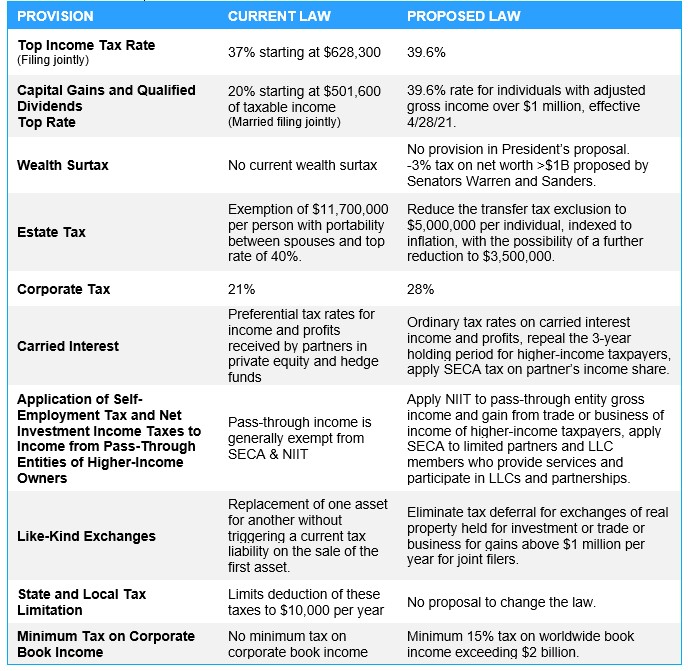

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

The Clash Over A Tax Break For Investors Is Intensifying Business Owners Should Take Notice Inc Com

Carried Interest The New Landscape

Certain Carried Interest Tax Changes In The Schumer Manchin Tax Reconciliation Bill Inflation Reduction Act Of 2022

Carried Interest Tax Increase May Come To Pass This Time Pensions Investments

State Taxes On Capital Gains Center On Budget And Policy Priorities

Carried Interest Explained Who It Benefits And How It Works

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Uk And Us Developments

Changes To Carried Interest Could Hurt South Texas Businesses Texas Border Business

How Private Equity Won Its Battle Over Carried Interest Barron S

How Does Carried Interest Work Napkin Finance

Tax Reform Watch Carried Interest Holding Period Pearl Meyer